Members have reported receiving suspicious phone calls requesting to validate their personal information and debit card or to provide their card number. The calls originated from a spoofed Lōkahi FCU phone number. Do not respond to these requests.

Be suspicious of calls posing as security employees, card companies and their fraud services, or other suspicious entities requesting for you to update, change, or provide personal information about your debit card, passwords, and other secure information.

As a reminder, Lōkahi Federal Credit Union will never ask for your personal or financial information or ask for you to provide your debit card number.

Also, closely monitor your card statements and accounts and report any unusual activities or discrepancies as soon as possible.

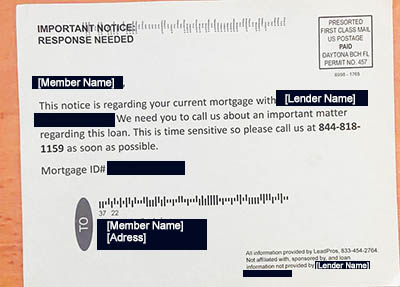

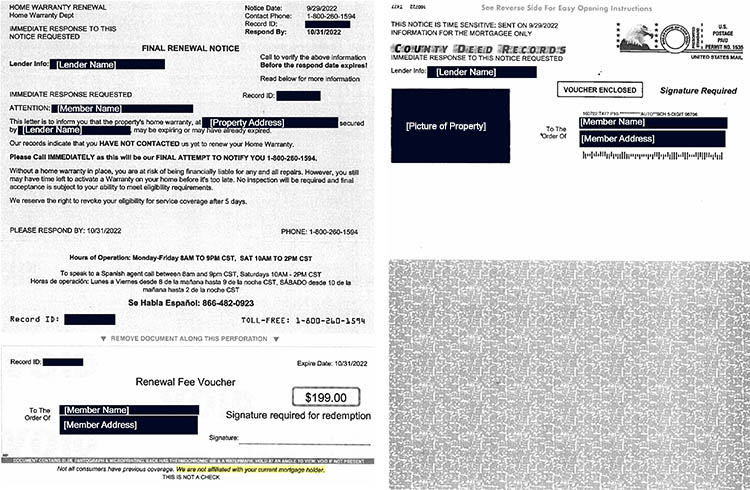

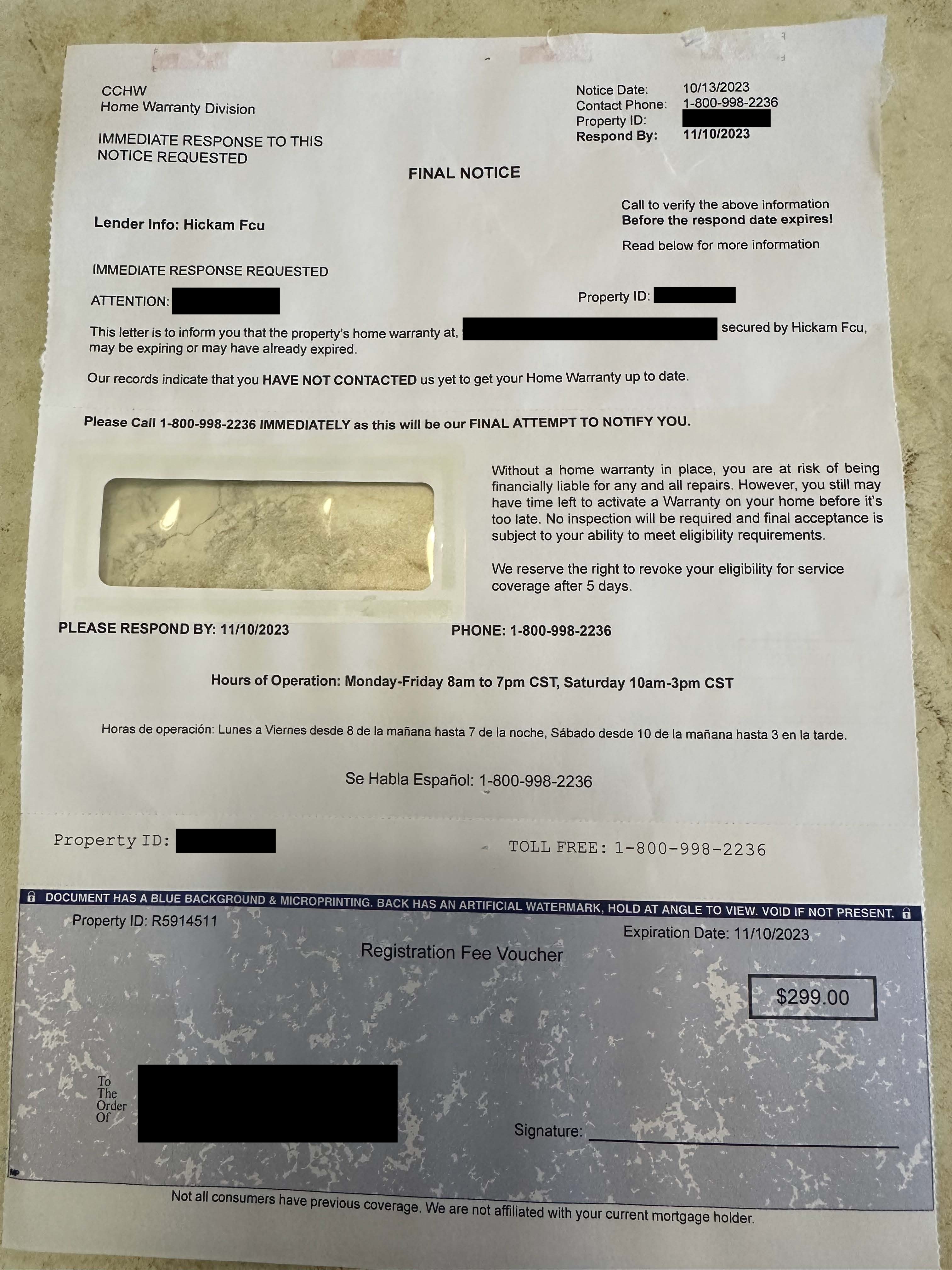

Fraudsters are obtaining property address, ownership, and lien holder information from public information sources such as local conveyance/deed and property tax records to scam homeowners into purchasing illegitimate products or services, or to obtain your personal information. These scammers offer homeowners with unnecessary services such as home warranties, recorded deed notices, protection insurance and other “urgent and time sensitive” offers.

Please know that financial institutions such as Lōkahi FCU do not share these types of information with non-affiliated companies. You may even notice a disclaimer that specifically states that “All information provided is not affiliated with, sponsored by, and loan information not provided by Lōkahi (or Hickam) Federal Credit Union." We recommend that if you receive such offers in the mail, please do not respond to their request for contact and securely discard the mail piece.

Here are a few examples:

With the tragedies unfolding on Maui and Hawai'i Island, scammers are taking advantage of the crises to create fraudulent fundraisers. If you are looking for opportunities to donate or to help these communities, please use vigilance when selecting a charity. The Department of the Attorney General Hawai'i shared the following tips to avoid falling for donation scams:

If you have any questions or complaints regarding a scam charity, please contact the Tax & Charities Division at 808.586.1480, or send an email to [email protected].

The Honolulu Police Department is warning the public about credit card skimmers that are illegally installed at self-checkout registers, ATMs, and gas stations. These skimmers are attached to the actual card reader and will transmit credit and debit card information to thieves when a card is used.

If you believe a card skimmer has been illegally installed, notify an employee immediately.

If you notice fraudulent charges and suspicious activity on your accounts, please contact us.

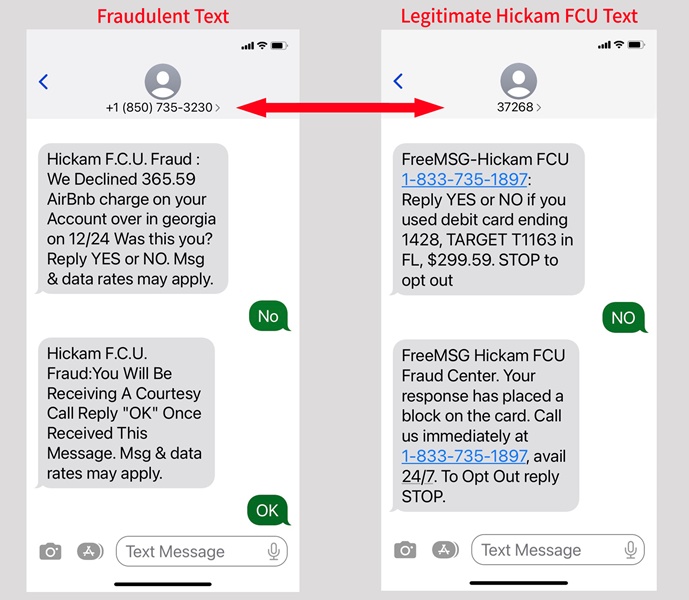

Fraudsters posing to be from Lōkahi (or Hickam) Federal Credit Union are sending fake SMS text messages. If you receive a SMS text message appearing to be from Lōkahi (or Hickam) FCU Fraud Department verifying transactions and text “You Will Be Receiving a Courtesy Call Reply “OK” Once Received This Message. Msg & data rate may apply” and you receive a call, DO NOT give sensitive information such as your account number, debit/credit card number, PIN number, expiration date of the card, 3-digit security code, online banking passwords, or personal information. Lōkahi FCU will not contact you to ask for this information.

If you receive a suspicious call or text message Contact us directly at (808) 423-1391.

Here is an example of a fraudulent text message compared to a real Lōkahi (or Hickam) FCU text message:

Reminder, if you are contacted by Lōkahi (or Hickam) FCU Fraud Prevention Department for your credit or debit card, please remember we will never ask for your Social Security numbers, PINs, or OTPs (one-time passcode). If the caller is asking for these type of information, hang up immediately and contact us. In addition, you should never respond NOT FRAUD to fraud alerts you did not perform, regardless of who instructs you to do so. Please continue to be diligent with your account monitoring and management, as this is the first line of defense when it comes to stopping fraud.